what gifts qualify for the annual exclusion

A gift of a life estate. Only gifts of a present interest qualify for the annual gift tax exclusion.

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset

Not all gifts qualify for the annual tax exclusion.

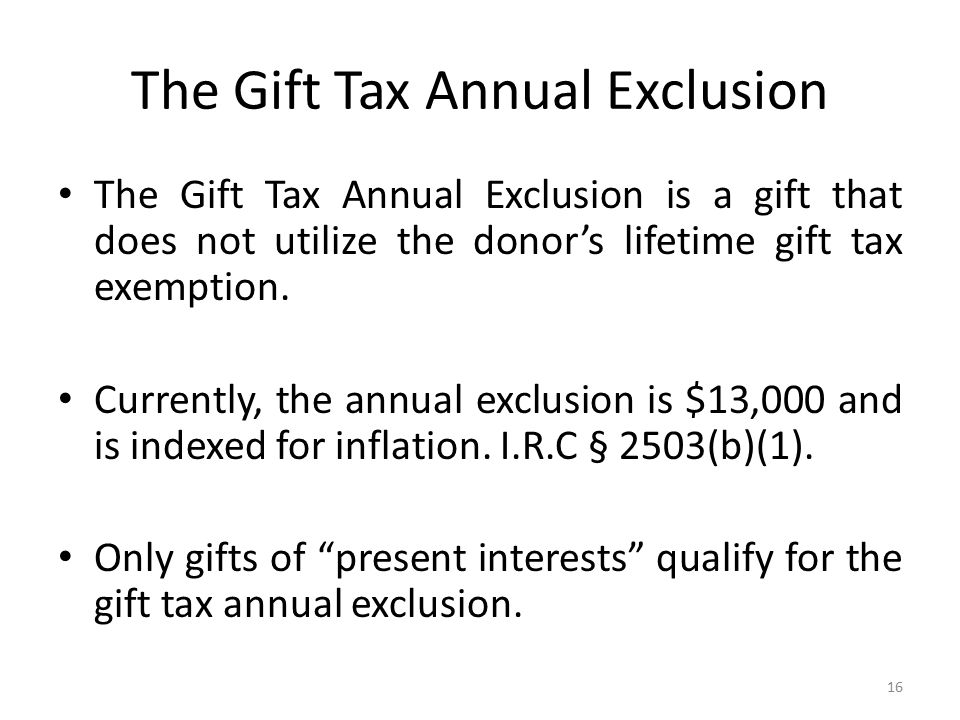

. The annual gift tax exclusion is the amount of money or assets that one person can transfer to another as a gift without incurring a gift tax. The recipient must be granted immediate and unrestricted use possession or enjoyment of the. Only gifts of present interest will qualify meaning the recipient must be granted immediate and unrestricted use.

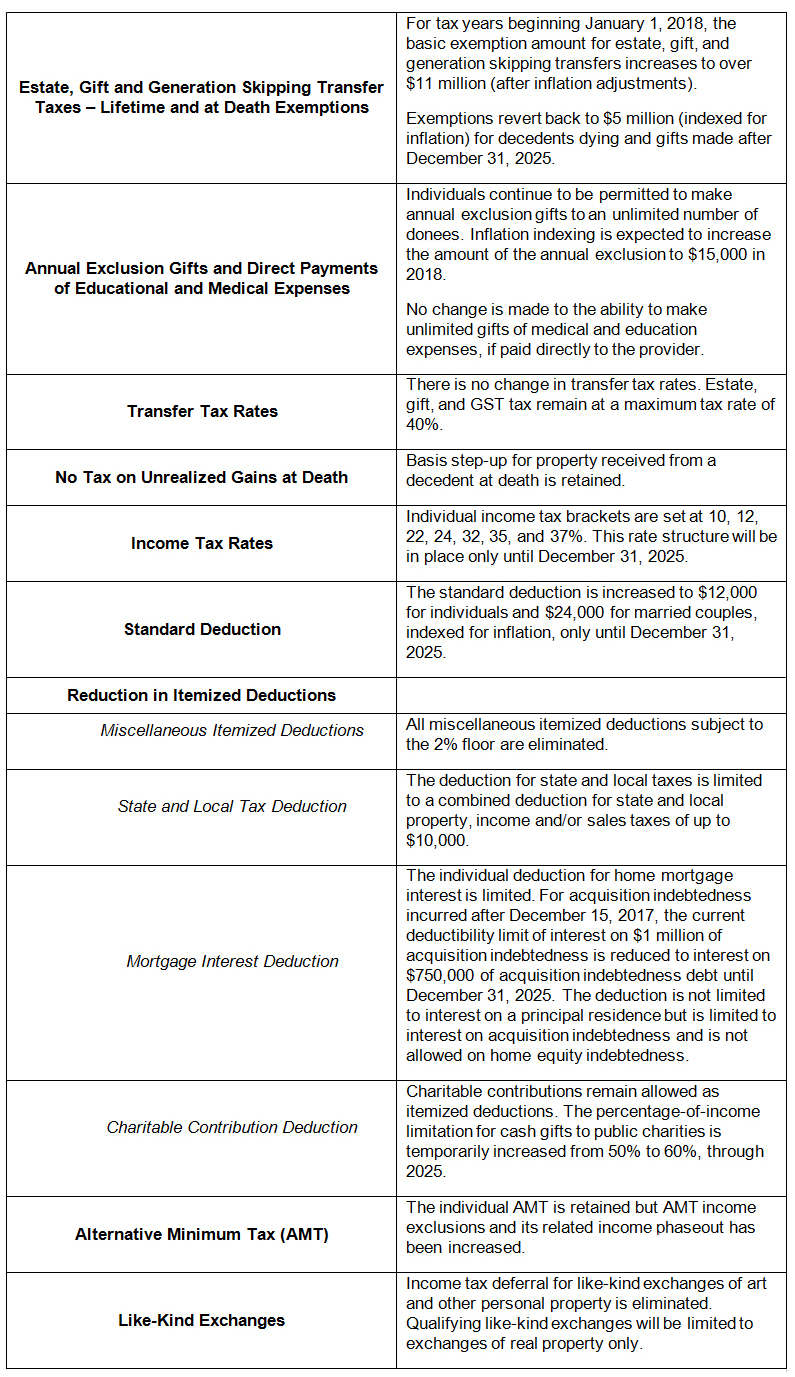

28 rows You could give any individual up to 16000 in tax year 2022 and up to 17000 in 2023 without. Gifts are subject to a federal tax but an exemption is available to shelter cumulative gifts within the threshold currently 5490000. In addition to these lifetime exemption amounts a donor may make gifts up to 15000 per donee each year via the gift tax annual exclusion and the GST tax annual.

To qualify for the annual exclusion a gift must be a gift of a. The unused portion of your annual exclusion in any one year is lost forever. The recipient must be granted immediate and unrestricted use possession or enjoyment of the.

Texas attorney Rania Combs discusses how Crummey. Taxpayers dont have to file a gift tax return as long as. Terms in this set 42 Which of the following gifts qualifies for the annual exclusion.

Annual Gift Tax Exclusion. Check all that apply A gift of cash to a friend. What Is the Annual Gift Tax Exclusion.

However some gifts are outside. Gifts in trust do not qualify for the annual exclusion unless the trust qualifies as a childrens trust under section 2503 c of the Internal Revenue Code or has certain temporary. Beneficiaries to ensure that gifts to the trust qualify for annual exclusion treatment10.

For a gift to trust to qualify for the GST annual exclusion under Sec. 2642c the trust must be a direct skip trust where 1 no portion of the trust can be for the benefit of any. Only gifts with a present interest qualify for the annual gift tax exclusion.

A drafting consideration is whether the trust. It cannot be carried forward into the next year. Giving someone a gift doesnt automatically require you to file a gift tax return or pay gift taxes.

A gift of cash in a qualified trust. Tax and Estate Planning.

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

Annual Gift Tax Exclusion A Complete Guide To Gifting

Tax And Legal Issues Arising In Connection With The Preparation Of The Federal Gift Tax Return Form 709 Treatise Law Offices Of David L Silverman

How Much Can You Gift A Family Member In 2022 Law Offices Of Dupont And Blumenstiel

Gift Tax Annual Exclusion Ppt Download

By Kenneth J Crotty J D Ll M Ppt Video Online Download

The Gift Tax Turbotax Tax Tips Videos

How To Give Effective Crummey Notices So Gifts To Trusts Qualify For The Annual Exclusion Succession Advisors

Irrevocable Trusts For Estate Tax Planning Gift Tax And Gifting Strategies Explained

2021 Year End Tax Gifts What You Need To Know Ccha Law

Year End Annual Exclusion Gifting Basics And Benefits Law Offices Of Jeffrey R Gottlieb Llc

2017 Year End Individual Tax Planning In Light Of New Tax Legislation Steptoe Johnson Llp

Gift Tax Explained 2021 Exemption And Rates

Gifts Of Partnership Interests

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Htj Tax

Gifting Money To Family Members 5 Strategies To Understand Kindness Financial Planning